Monthly Rankings: August 2024

From download surges to record-breaking revenue, here's a look at the shopping, social and gaming apps that captured users' attention and wallets in August.

In August 2024, the digital landscape saw a dynamic shift as top apps across shopping, social platforms, and gaming categories vied for dominance. From download surges to record-breaking revenue, here's a look at the apps that captured users' attention and wallets last month.

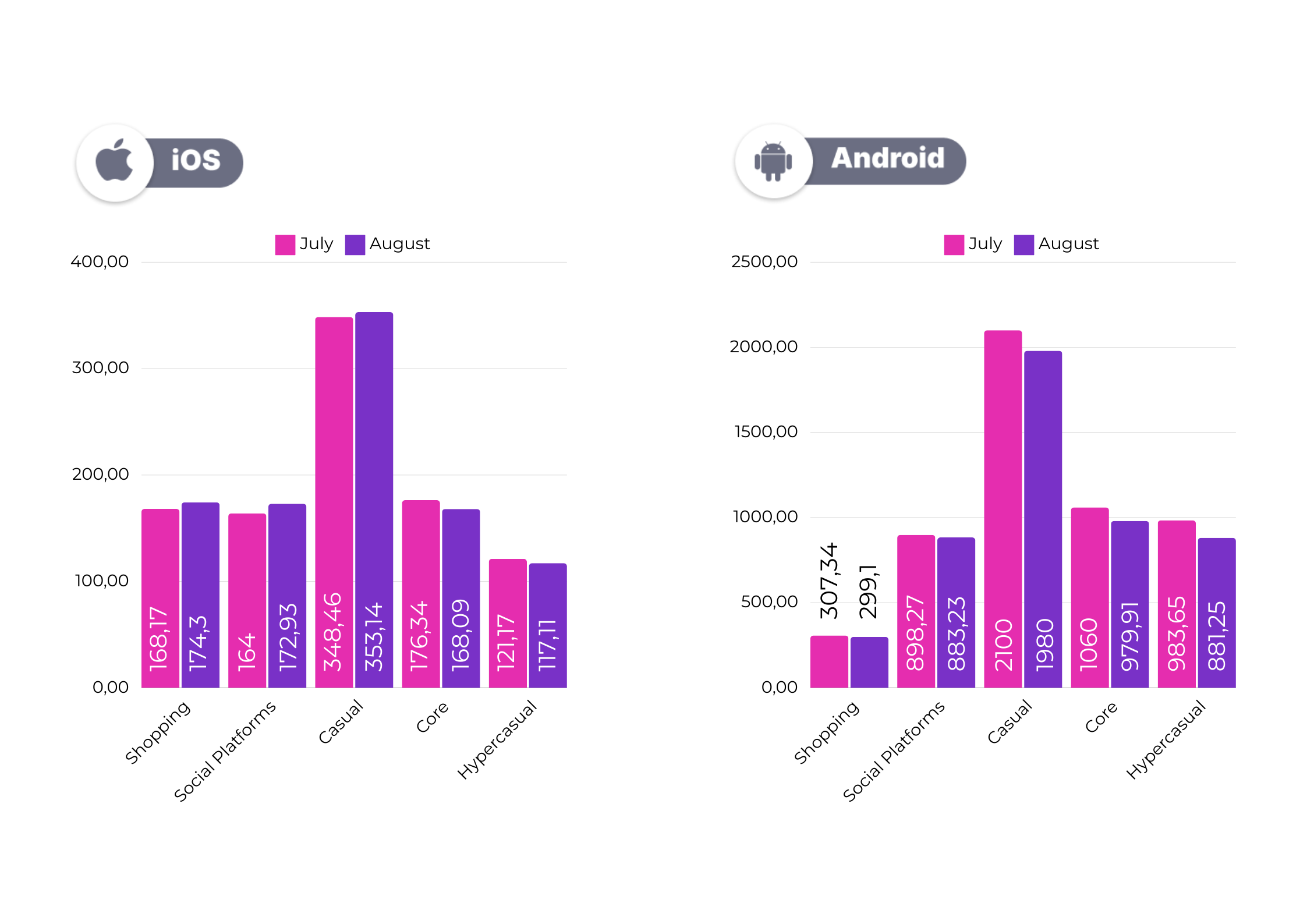

In August 2024, shopping apps showed consistent growth on iOS, but a slight decrease on Android. iOS saw a modest increase from 168.17 million downloads in July to 174.3 million in August, while Android showed a decline from 307.34 million in July to 299.1 million in August. Social platforms displayed an insignificant fall on Android (-1.67%), but bettered the indicators on iOS a bit (+5.45%).

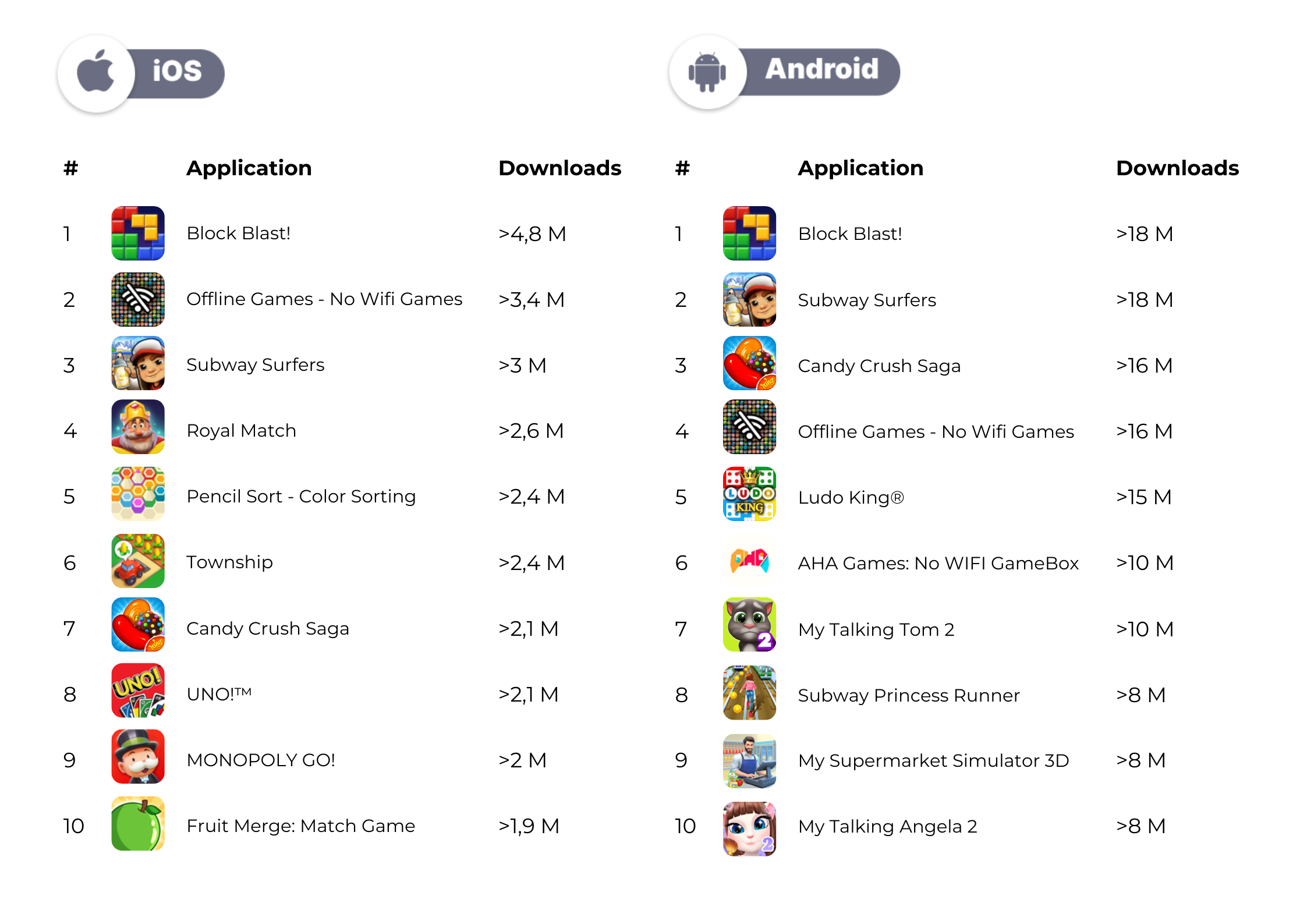

The casual gaming category experienced a notable drops on Android (from 2.1 billion to 1.98 billion). On iOS, downloads improved by 1.34% MoM in August. Core games had minor negative fluctuations across both platforms. Hypercasual games, however, saw some decreases across both platforms, particularly on Android, where downloads dropped from 983.65 million in July to 881.25 million in August.

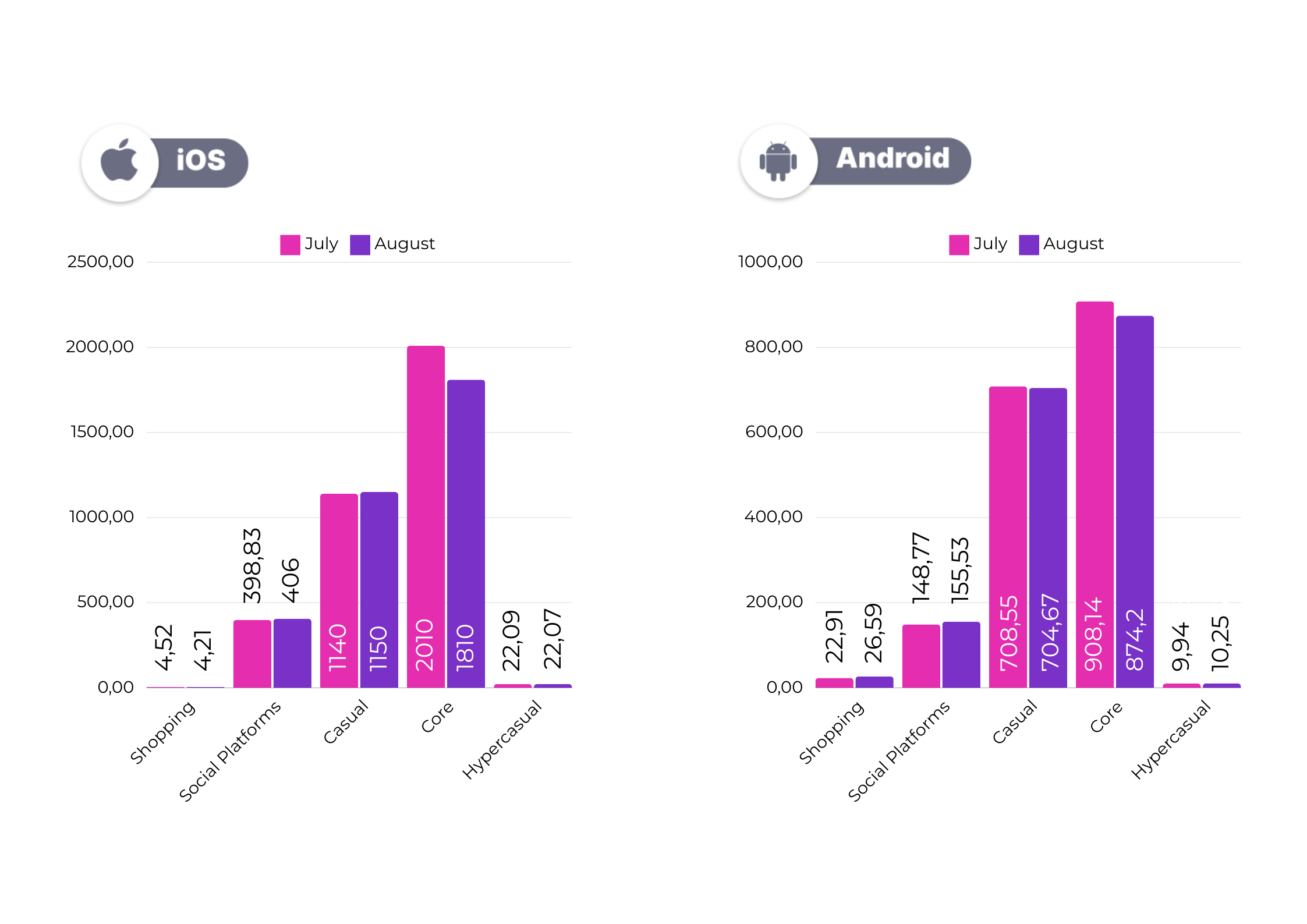

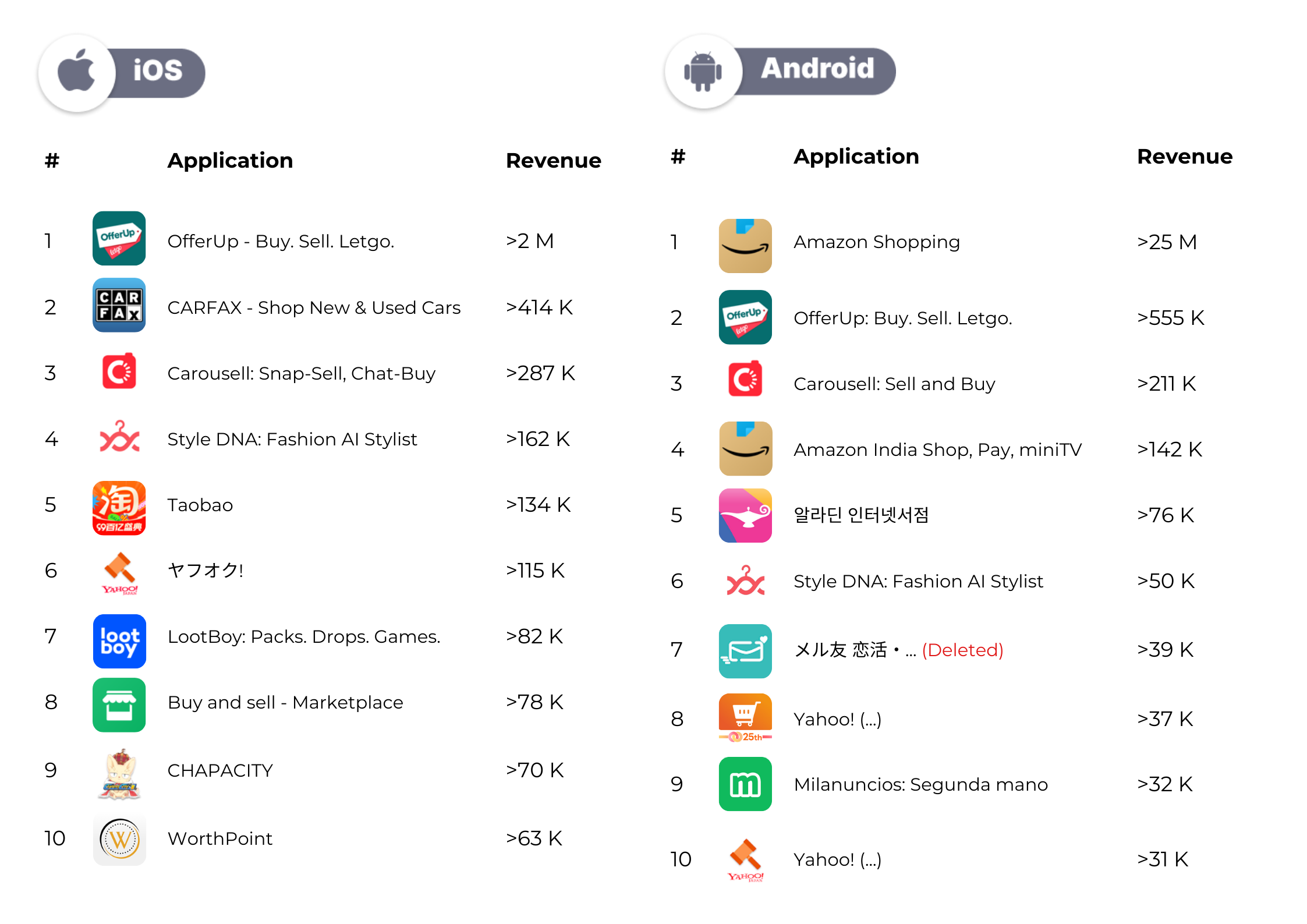

In shopping, Android revenue increased from $22.91 M in July to $26.59 M in August, indicating growing consumer spending. On iOS, however, revenue slightly declined by 6.86%, suggesting a minor dip in purchases.

Social platforms showed steady growth, with iOS revenue rising from $398.83 M in July to $406 M in August, and Android increasing by 4.54%, reflecting stable engagement and monetization across platforms.

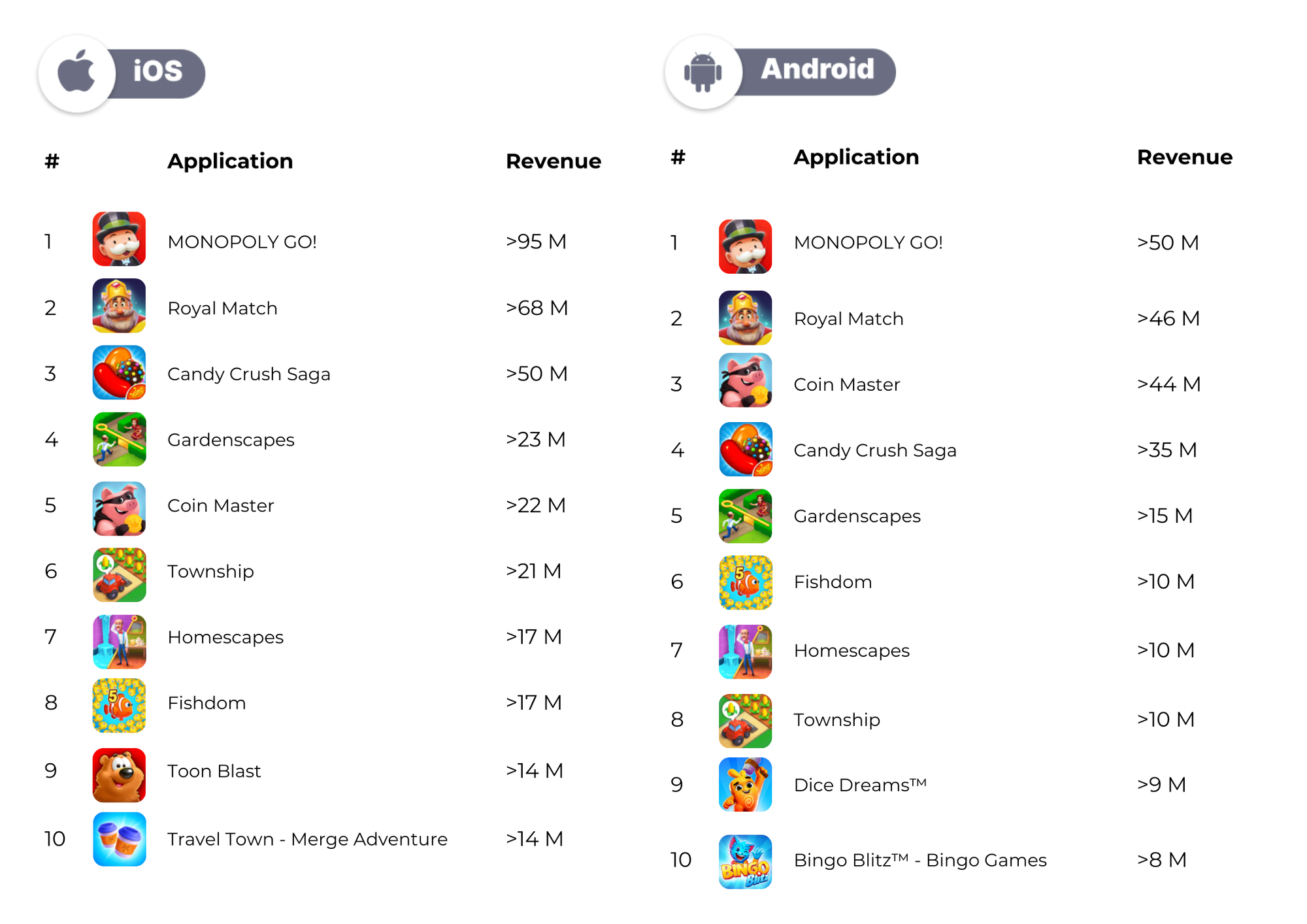

Casual games saw small but steady growth on iOS: revenue increased from $1.14 B to $1.15 B, while on Android it declined by 0.55%. Core games experienced a drop across two platforms: on iOS, revenue fell from $2.01 B in July to $1.81 B in August, and on Android, from $908.14 M to $874.2 M, indicating decreased spending.

Hypercasual games remained rather stable, with iOS revenue slightly decreasing by 0.09%, and Android somewhat rising by 3.12%, suggesting consistent and slightly growing willingness to make IAP.

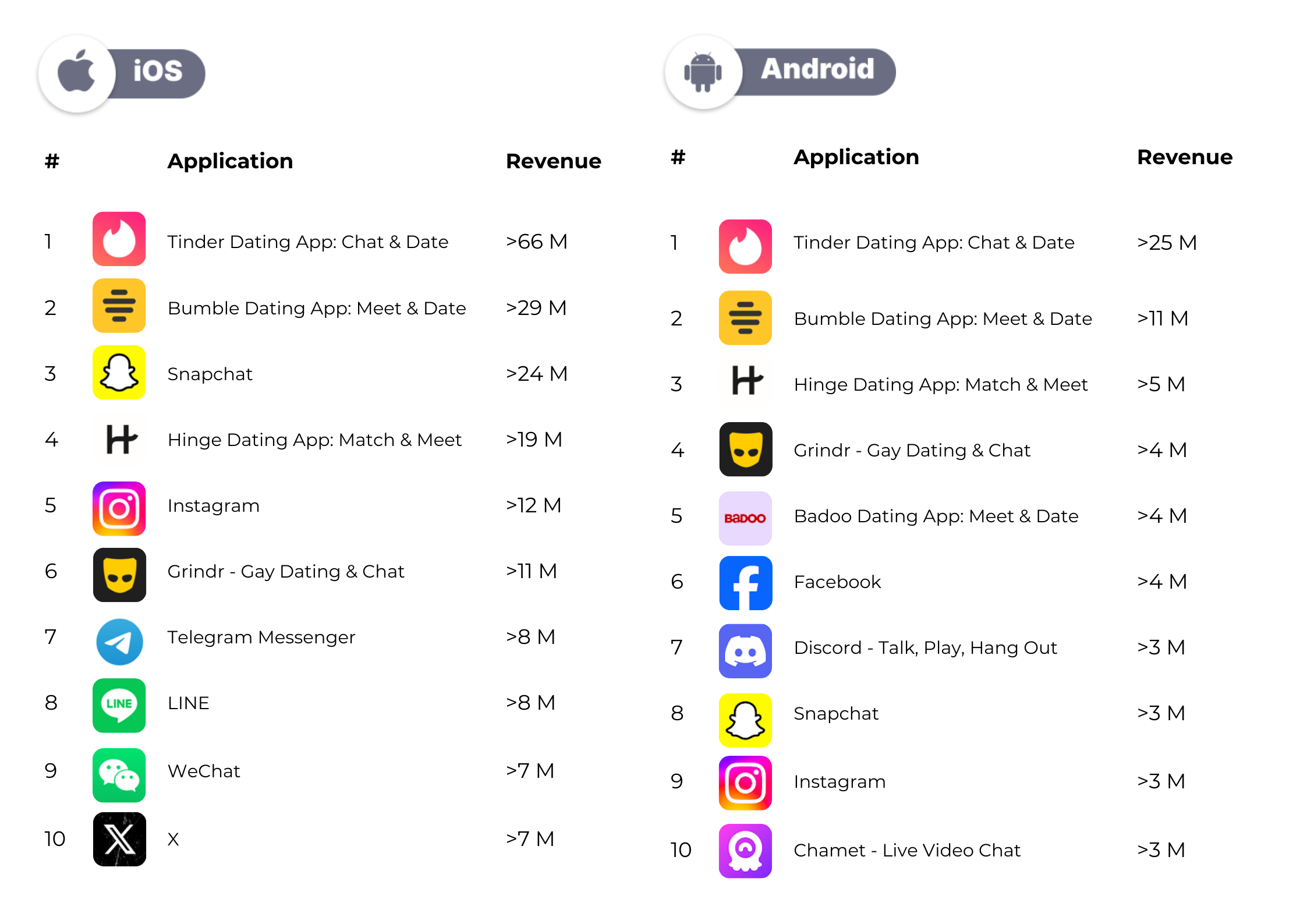

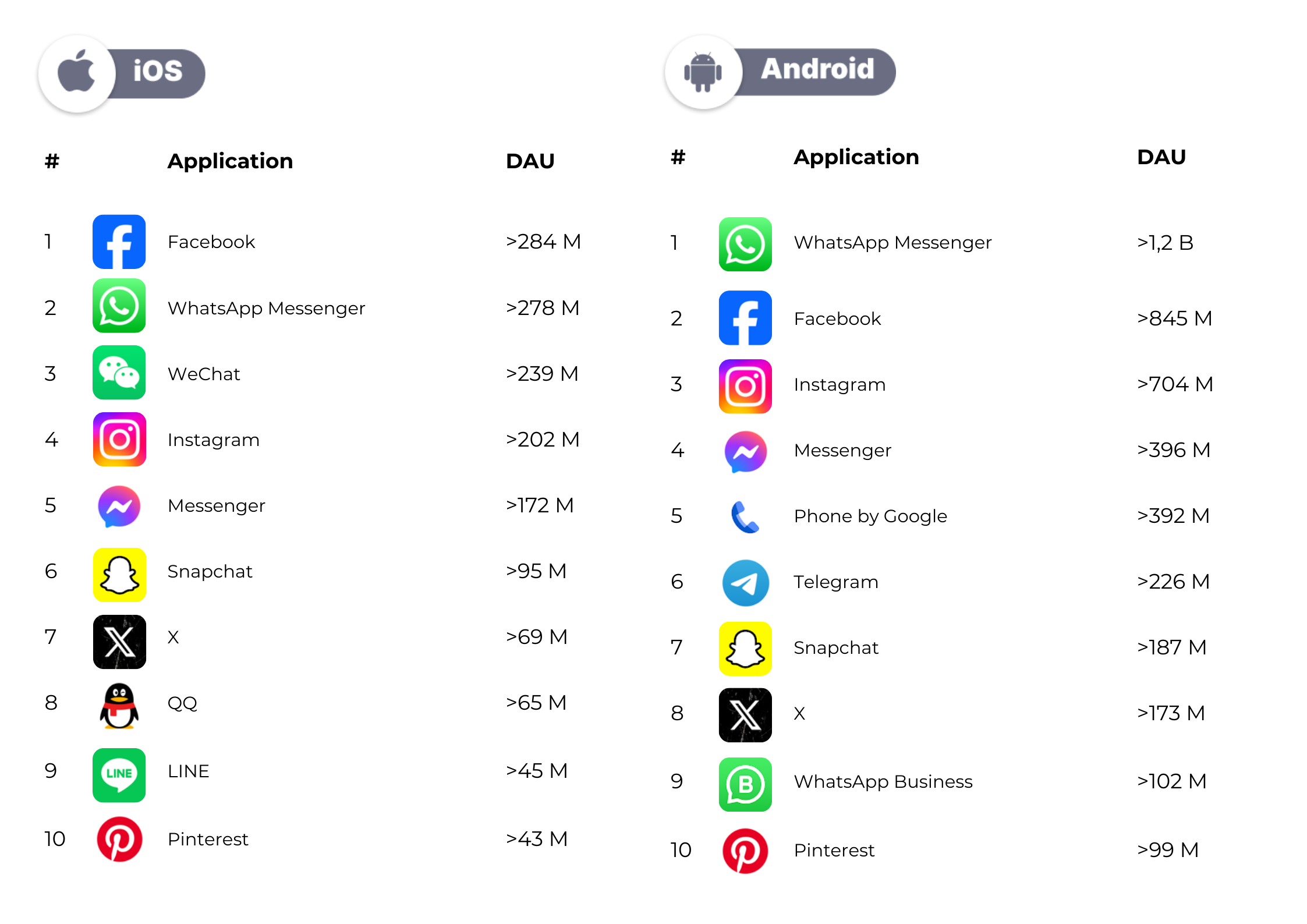

Top Social Platforms | Downloads, Revenue, DAU

Interesting note: iOS users consistently outspend Android users across most top social apps, particularly in the dating category where Tinder leads with more than $66 M on iOS versus $25 M on Android. Apps like Bumble and Snapchat also see significantly higher revenues on iOS. However, Chamet, a live video chat app, made an interesting entry on Android's top 10 with over $3 M, highlighting a unique trend in live-streaming app popularity on this platform.

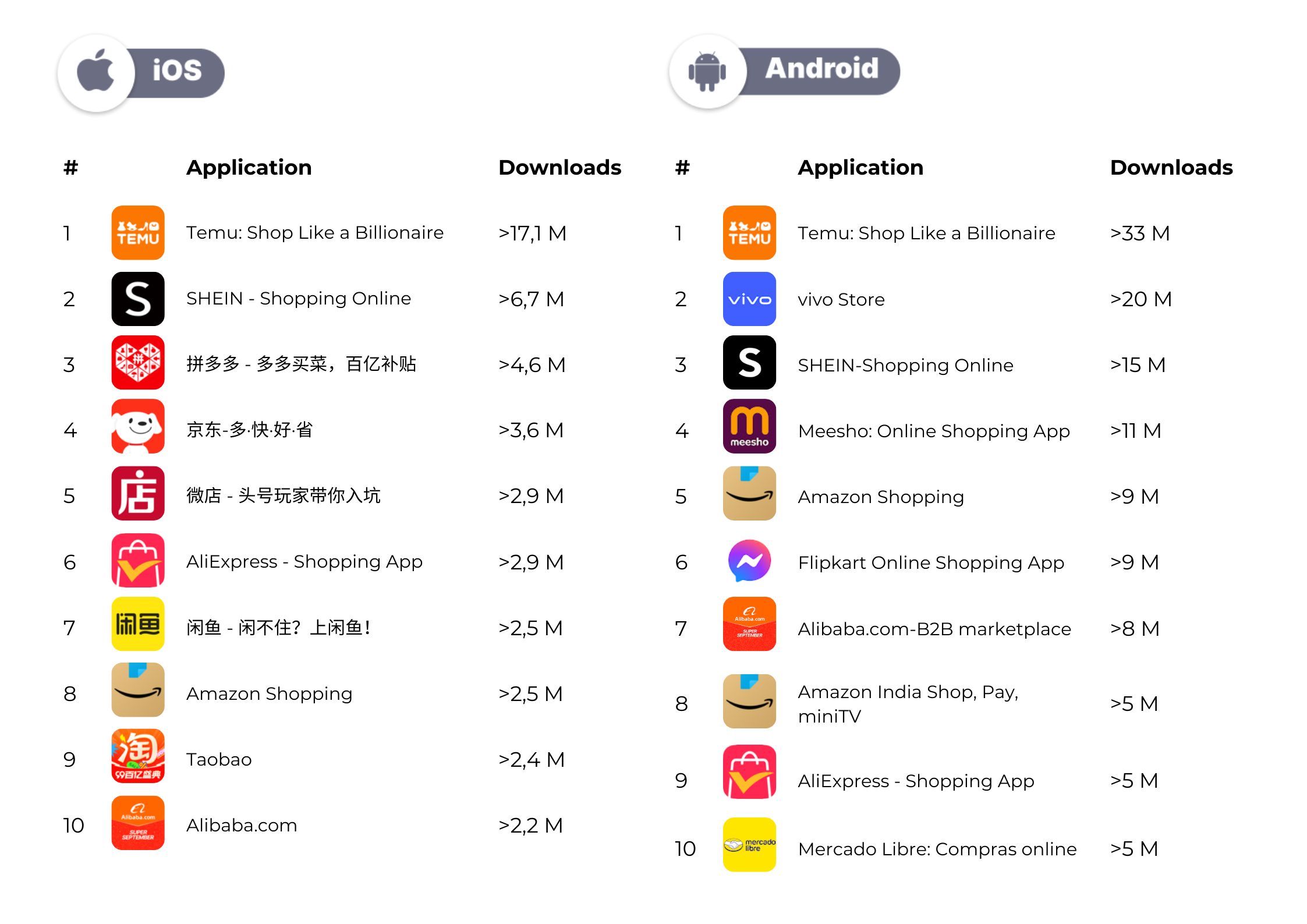

Top Shopping Apps | Downloads, Revenue, DAU

During the last month, Pinduoduo shopping app on iOS led with over 115 million DAU, while Flipkart topped Android with 84 million DAU, highlighting regional dominance in China and India, respectively. Amazon maintained a strong global presence across both platforms, and social commerce app Meesho showcased high indicators with over 27 million DAU on Android, reflecting the interest to peer-to-peer e-commerce.

Top Casual Games | Downloads, Revenue, DAU

In August, Monopoly GO! dominated both platforms by revenue, earning over $95 million on iOS and $50 million on Android. Royal Match, Coin Master, Candy Crush Saga and Gardenscapes also showed strong cross-platform performance, consistently ranking in the top five.

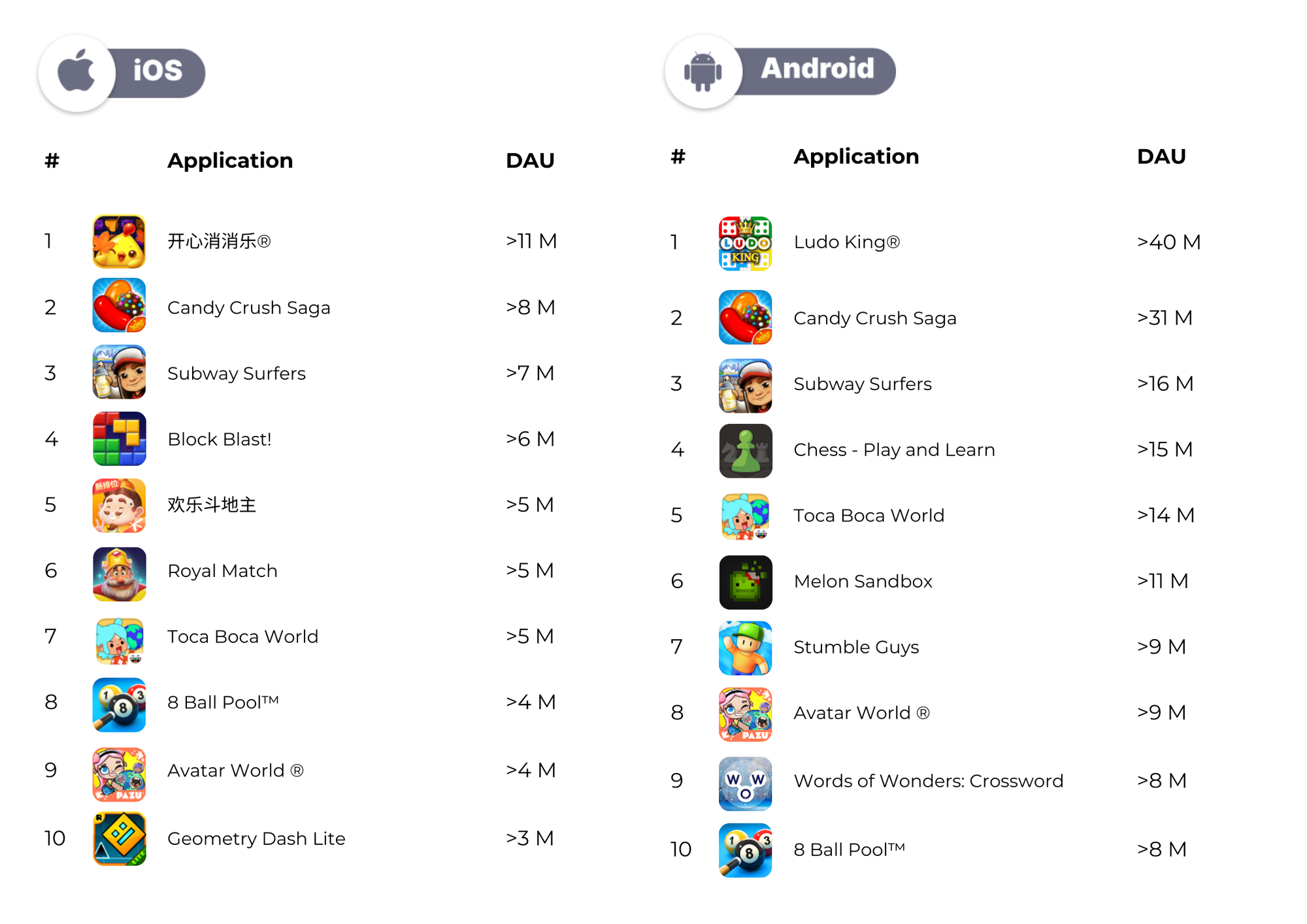

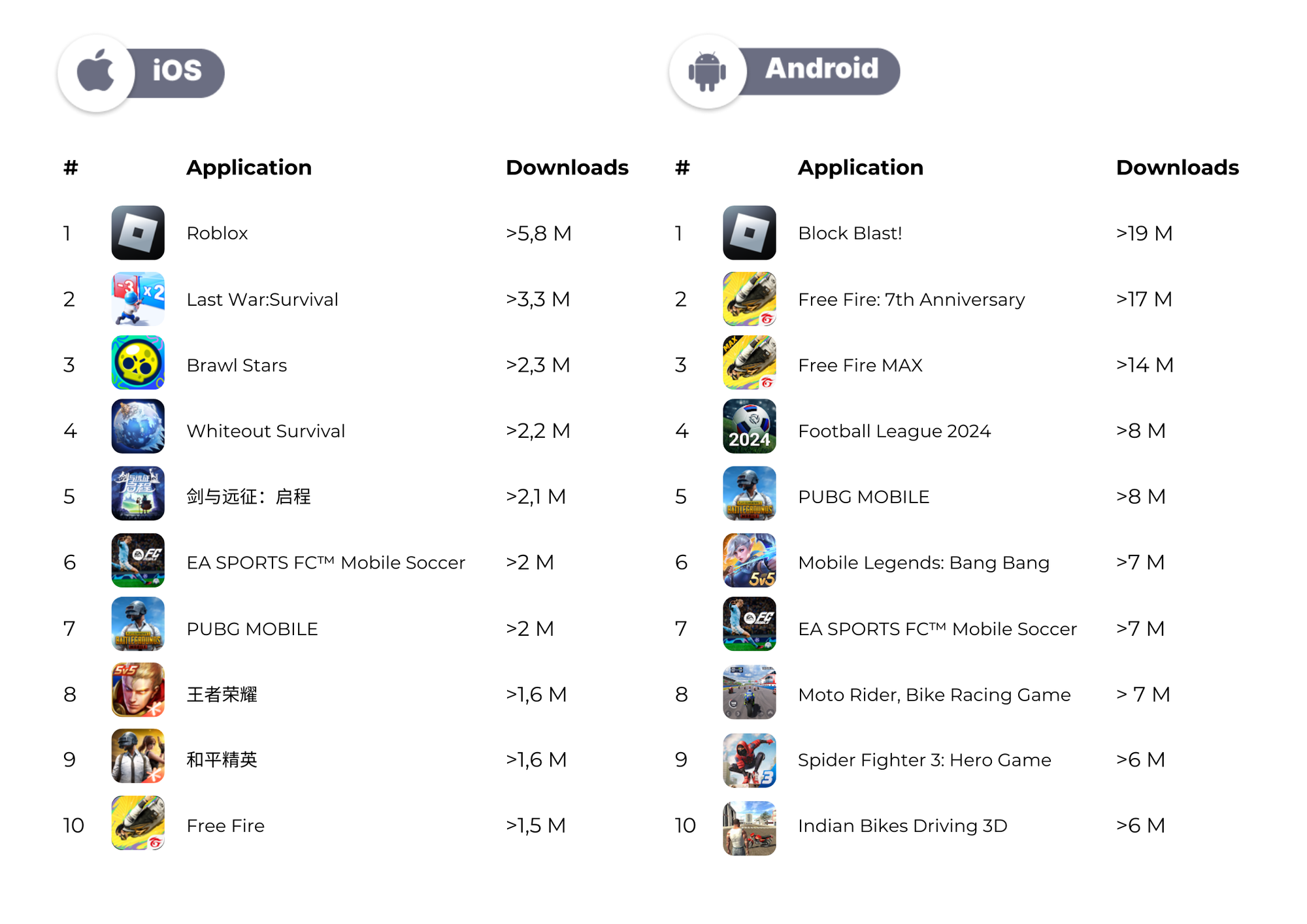

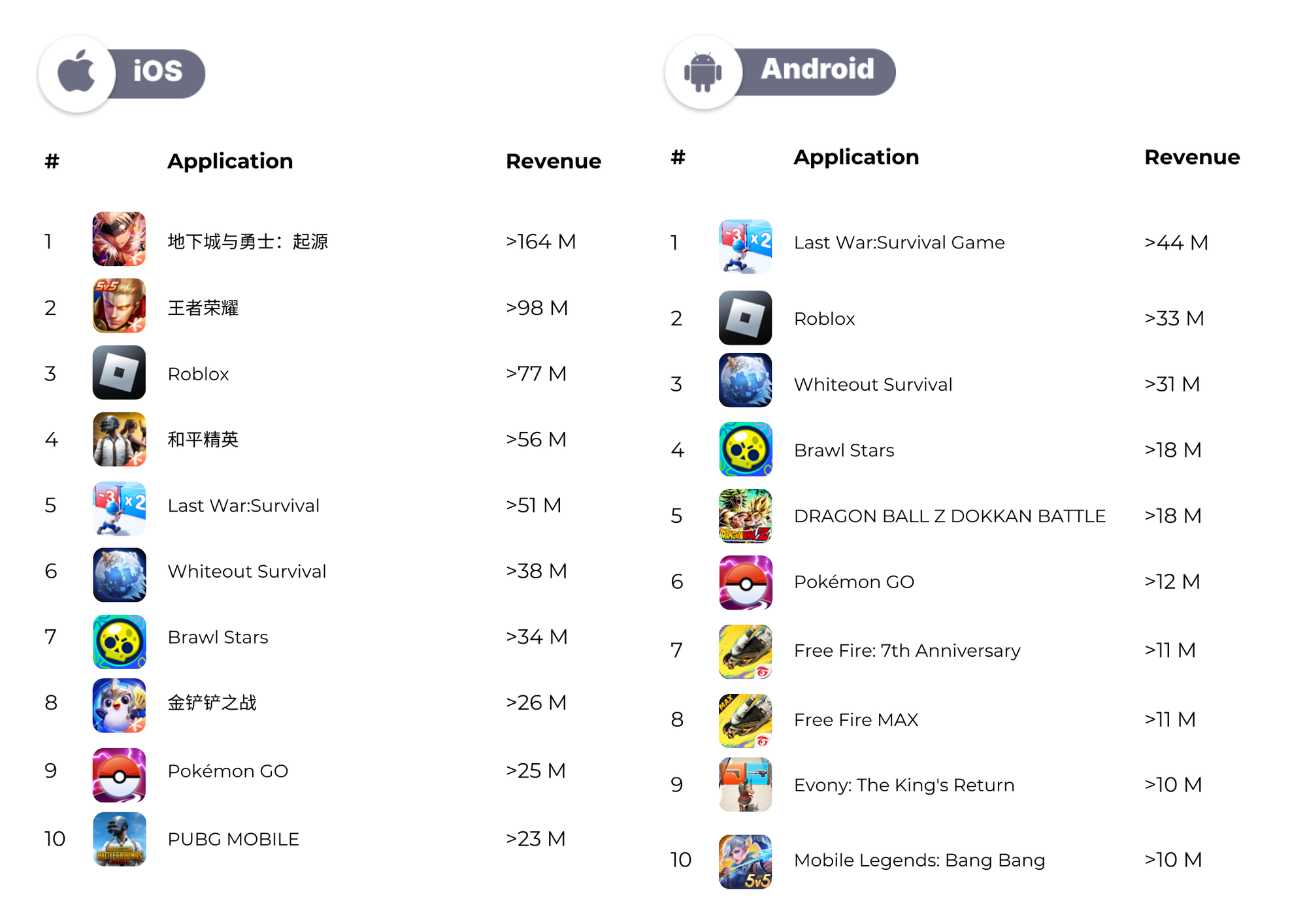

Top Core Games | Downloads, Revenue, DAU

In August 2024, Roblox dominated both platforms by engagement, leading with over 37 million DAU on iOS and an impressive 98 million DAU on Android. Free Fire MAX also showed strong performance on Android with 46 million DAU, while Mobile Legends: Bang Bang secured a spot in the top three with 33 million DAU.

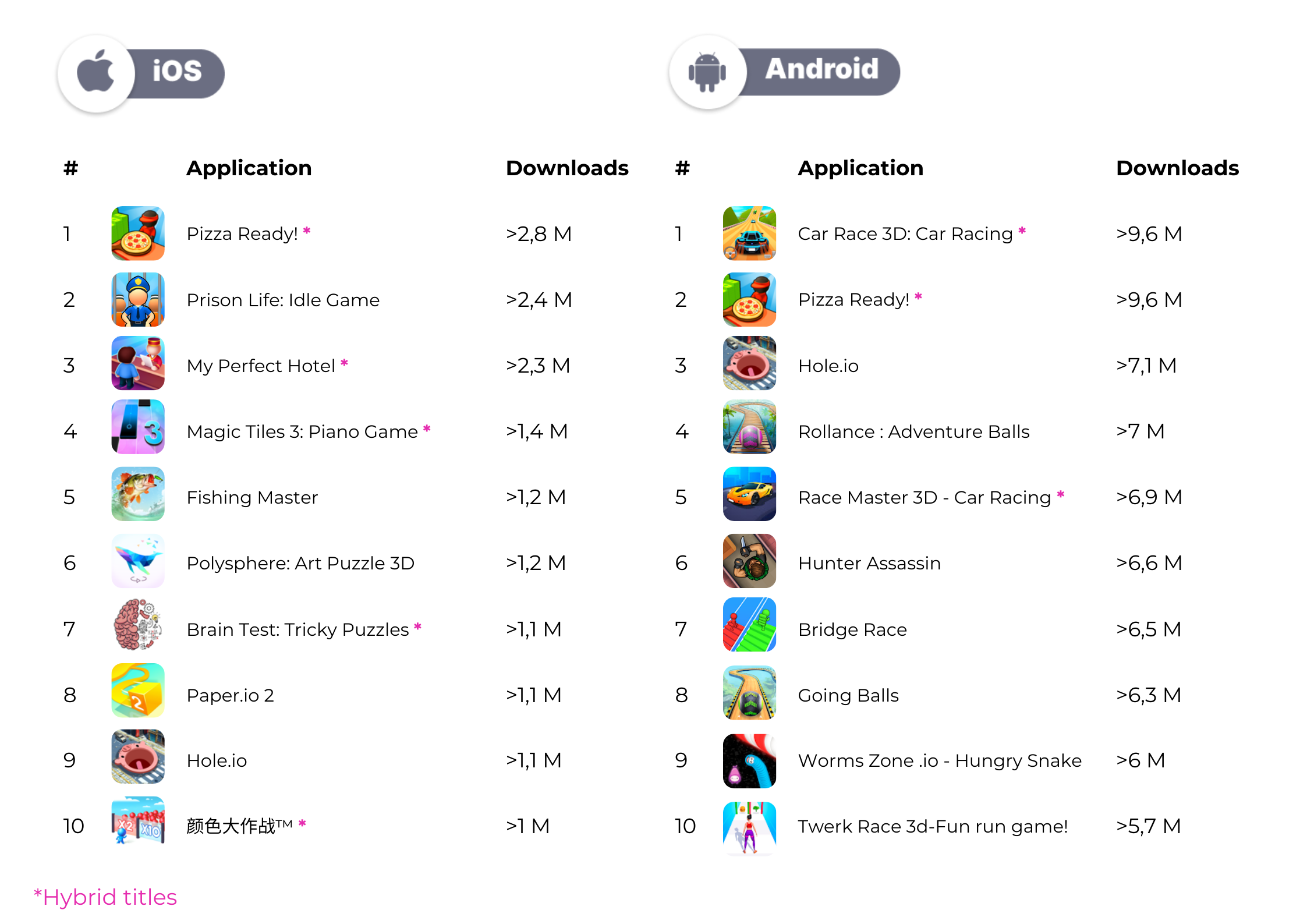

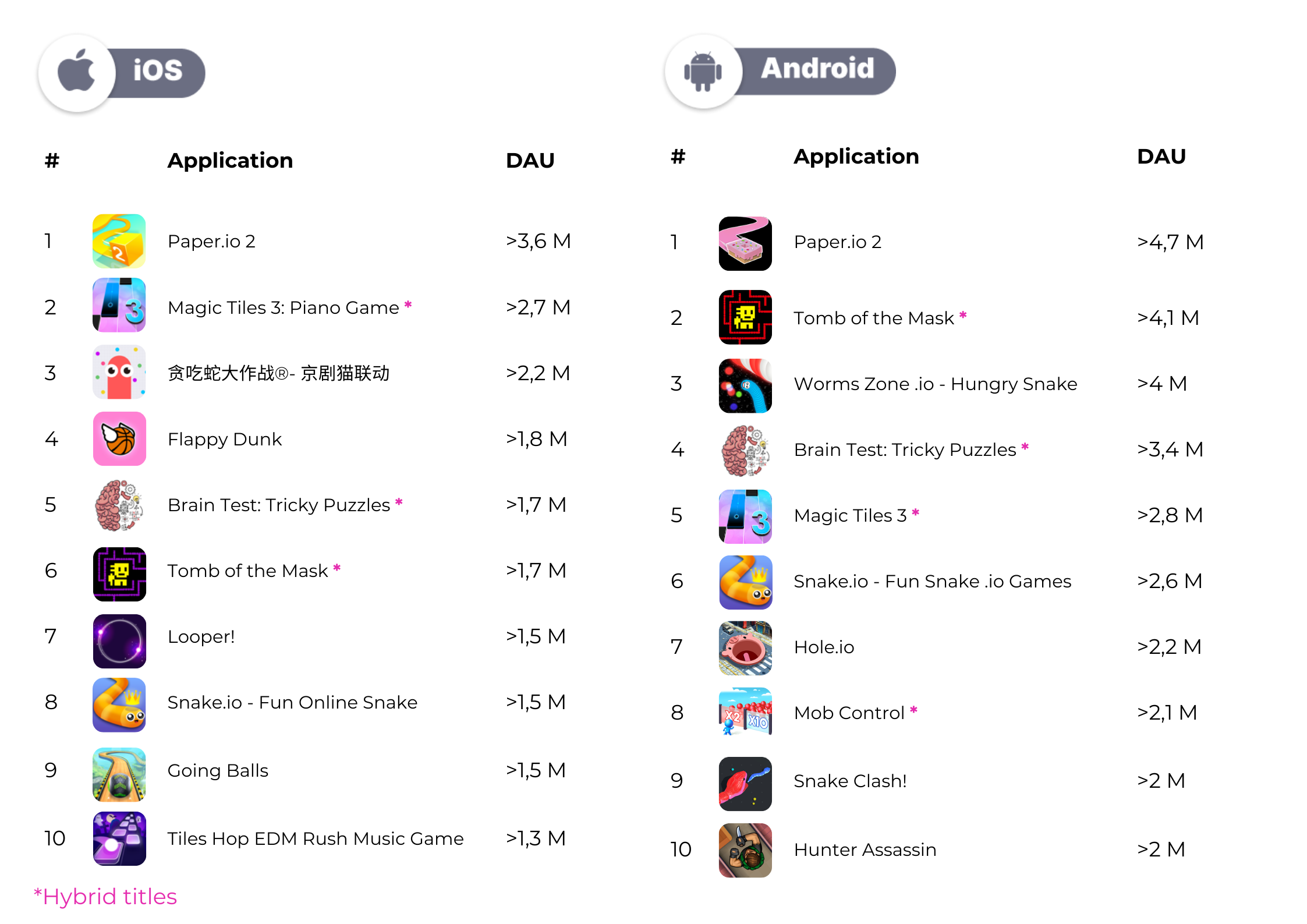

Top Hypercasual Games | Downloads, Revenue, DAU

Hypercasual titles faced lower numbers of downloads, revenue and active users comparing to the casual and core ones. Please, note that, for now, we put hybrid titles in a hypercasual ranking.

All in all, gaming sector showcased a slight fall both in downloads and revenue declining by 8% in installs and by 4.79% in revenue in August compared to July.